Early-stage startups around the world are tackling big challenges with innovative solutions. From AI to fintech and biotech, the following five young companies (pre-seed through Series A) have attracted attention for their strong growth potential, recent traction, and bold visions. Each is poised to disrupt its industry and deliver outsized impact if their momentum continues.

Summary of Featured Startups:

Below is a quick overview of the five startups, including their sector, home country, funding stage, and a key growth highlight:

Startup | Sector | Country | Stage | Growth Highlight |

Character.AI | AI (Generative AI) | United States | Series A (2023) | ~100M monthly site visits in 6 months; raised $150M at $1B valuation |

Wave Mobile Money | Fintech (Payments) | Senegal | Series A (2021) | First unicorn in Francophone Africa ($1.7B val); expanding mobile money across West Africa |

Aerones | Robotics/Clean Energy | Latvia | Series A (2022) | Robots serviced 5,000+ wind turbines in 19 countries; raised ~$39M to scale operations |

Epigenic Therapeutics | Biotech (Gene Therapy) | China | Series A (2023) | Pioneering epigenetic gene therapies for multiple diseases; raised $32M from top VCs for R&D |

Truora | SaaS (RegTech) | Colombia | Series A (2022) | WhatsApp-based user onboarding platform; $15M Series A at $75M valuation with 400+ clients in 9 countries |

Below, we delve into what each startup does, why it’s promising, and the momentum behind it.

Character.AI

Character.AI’s mobile app interface showcases its AI chatbot platform.

What it does: Character.AI is a generative AI startup that enables users to create and chat with customizable artificial personalities. The Palo Alto-based company, founded by ex-Google researchers, provides an AI chatbot platform where each “character” can have distinct personalities and knowledge. Users can even create their own digital characters for purposes ranging from entertainment and roleplay to drafting emails and study assistance. This innovative AI product capitalizes on the surging interest in consumer-facing AI, offering an experience that feels like chatting with an imaginative, self-made virtual companion.

Why it’s promising: Despite having no current revenue model, Character.AI demonstrated explosive user growth. Within six months of its late-2022 launch, it was already receiving about 100 million monthly site visits – a trajectory comparable to OpenAI’s ChatGPT in terms of rapid user adoption. The startup raised a $150 million Series A round led by Andreessen Horowitz at a $1 billion valuation, extraordinary for a company at this stage. This massive funding (for a pre-revenue company) is fueling development of the startup’s self-built large language models and expanding its small team. Character.AI’s blistering user engagement – with average sessions reportedly over 2 hours – and its backing by top-tier investors underscore a significant market opportunity. As generative AI continues to transform how we search and interact online, Character.AI is well-positioned to scale a highly engaging AI product to a broad consumer audience.

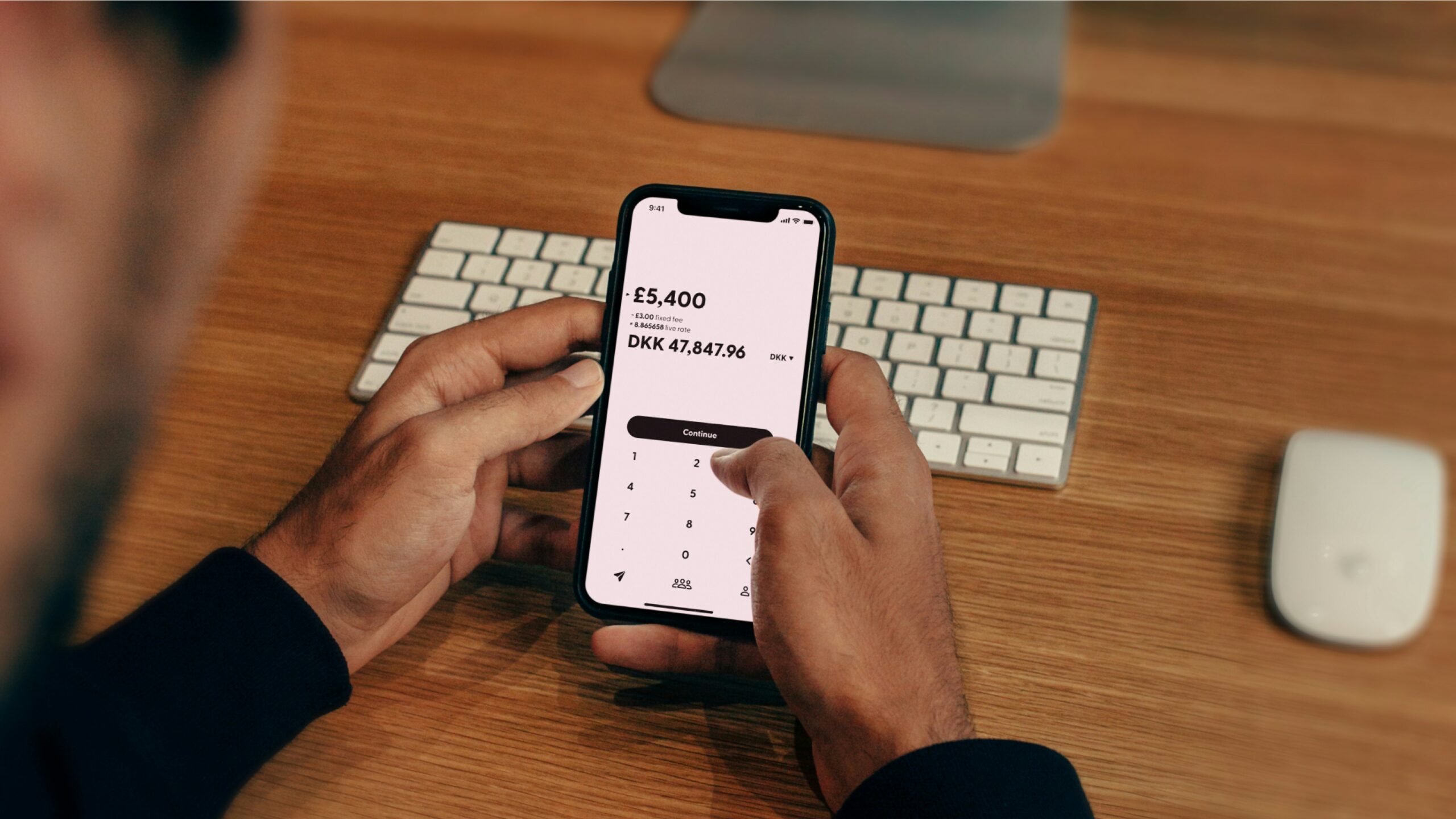

Wave Mobile Money

Wave’s penguin logo reflects its friendly, accessible mobile money app.

What it does: Wave is a Senegal-based fintech startup offering a mobile money service that makes it easy and affordable for anyone to save, transfer, and pay with their phone. Operating in several West African countries, Wave’s app provides a fast, low-cost alternative to traditional banking – a crucial innovation on a continent where the vast majority of people remain unbanked. Users can deposit and withdraw cash through local agents, pay bills, and send money to others with near-zero fees, all through a simple wallet app. By leveraging ubiquitous mobile phones and a network of agents, Wave aims “to bring digital finance to everyone in Africa” and build a truly inclusive, cashless financial system.

Why it’s promising: Wave has exhibited exceptional growth and investor confidence for an early-stage African startup. In 2021, Wave raised a record-breaking $200 million Series A, vaulting its valuation to $1.7 billion and making it the first unicorn in Francophone Africa. This round — co-led by renowned investors including Sequoia Heritage, Stripe, and Founders Fund — was unprecedented in size for the region, reflecting the vast market potential of mobile money in Africa. Wave’s user base expanded rapidly by solving real problems: it offers drastically cheaper fees compared to telecom-led mobile wallets and a user-friendly interface (hence the waving penguin mascot). With the new funding, Wave has been expanding across West Africa and growing its team to meet demand. The startup’s ability to leapfrog traditional banks and convert cash-based users to digital finance has huge implications for financial inclusion. If Wave continues its momentum, it could become a dominant pan-African financial platform, much like M-Pesa in East Africa, but with an even more scalable, tech-driven model.

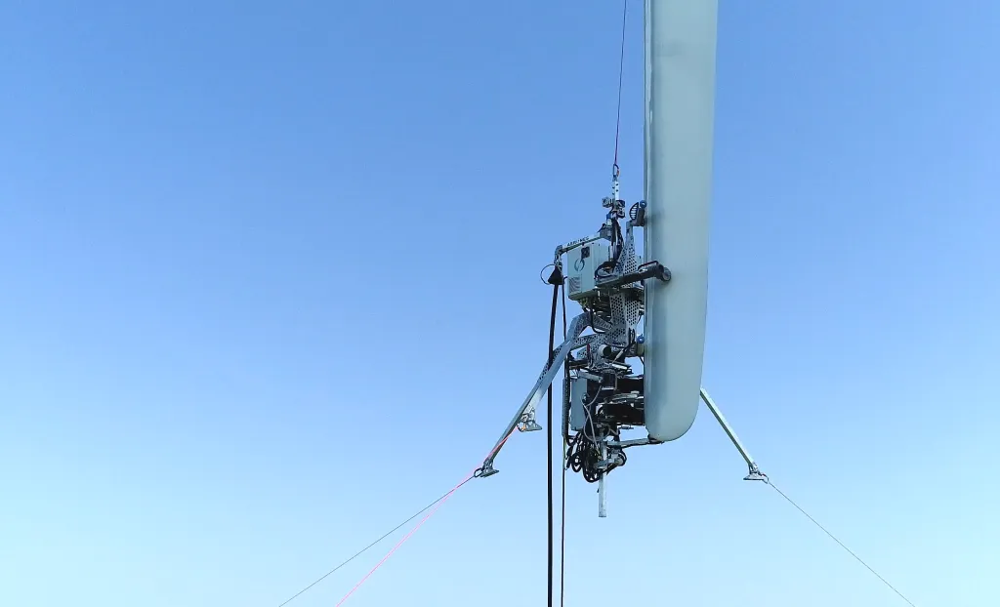

Aerones

Aerones’ robotic system clings to a wind turbine blade, performing automated cleaning and inspection.

What it does: Aerones is a Latvian robotics startup focused on automated wind turbine maintenance and inspections. Rather than sending human technicians up hundreds of feet in the air, Aerones deploys ground-controlled robots that clean turbine blades, apply protective coatings, and perform inspections using sensors and cameras. The robots, which attach to the turbine via winches, can blast blades with detergent to remove oil and dirt, and use ultrasound scanners to detect internal faults – all while a system of funnels catches runoff for reuse. By automating these dangerous and time-consuming tasks, Aerones improves safety and significantly reduces downtime for wind farms. The company also provides detailed data reports, helping wind farm operators predict maintenance needs and improve energy output.

Why it’s promising: Aerones addresses a critical bottleneck in the booming wind energy industry – maintaining thousands of turbines efficiently as they age. The startup has proven demand for its solution, having serviced over 5,000 wind turbines across 19 countries to date. This traction attracted notable investors: Aerones went through Y Combinator and secured about $39 million in fresh funding (late 2022 into 2023) to scale its services. The $30 billion wind turbine maintenance market is ripe for tech disruption, and Aerones has a first-mover advantage with its robotics platform. With its latest funding, the company is rapidly expanding operations and already counts 9 of the world’s 10 largest wind companies as clients. As renewable energy capacity grows, Aerones’ technology offers a scalable way to keep turbines running at peak efficiency – a value proposition with global appeal. Their growth potential is amplified by the urgent push for clean energy: more wind farms means a greater need for automated upkeep. Aerones is uniquely positioned to become a key industrial tech provider in the renewable energy supply chain, all while making green energy maintenance safer and smarter.

Epigenic Therapeutics

What it does: Epigenic Therapeutics is a Shanghai-based biotech startup pioneering a new frontier of gene therapy. The company is developing treatments using epigenetic editing – an approach that modulates the expression of genes without altering the underlying DNA sequence. Epigenic leverages CRISPR-based tools to essentially switch genes on or off (through epigenetic markers) to combat disease, avoiding the permanent changes and potential safety issues of traditional gene editing. The startup’s platform, called EPIREG™, uses AI to design precise epigenome modulators that can durably silence or activate target genes. Epigenic’s pipeline includes candidates for cardiovascular and metabolic diseases, ocular disorders, viral hepatitis, and rare genetic conditions – conditions that may be difficult to treat with conventional gene therapy or small molecules.

Why it’s promising: Epigenic sits at the cutting edge of biotech innovation, in a field attracting significant excitement and capital. In August 2023, Epigenic Therapeutics raised $32 million in Series A financing co-led by Qiming Venture Partners and OrbiMed. These top-tier investors were drawn by Epigenic’s potential to deliver “breakthrough” medicines using its epigenetic modulation technology. The influx of funding will fuel preclinical research and initial clinical trials for the company’s first therapies, as well as expansion of its team and technology platform. Epigenetic editing holds promise to address diseases that traditional gene editing cannot easily fix, by providing a reversible and finely tuned way to control genes. Epigenic is one of only a handful of startups globally in this arena, putting it in a competitive but high-upside race. If its science pans out, Epigenic could produce treatments for major chronic illnesses with fewer risks than cutting DNA – a transformative proposition in healthcare. With China’s growing biotech ecosystem and strong investor backing, Epigenic has the momentum to advance this next-gen gene therapy approach toward the clinic, targeting huge markets in need of novel solutions.

Truora

What it does: Truora is a Colombia-founded, Latin America-focused startup offering a user authentication and onboarding platform for businesses, with a unique twist – it operates via WhatsApp. Truora’s SaaS allows companies to verify and onboard their users through the ubiquitous messaging app, leveraging chatbots to handle tasks like ID document verification, biometric checks (face recognition), background checks, and digital forms. By meeting users where they already are (on WhatsApp), Truora helps banks, fintechs, marketplaces and gig platforms in LatAm drastically reduce friction in customer onboarding. The platform integrates security and KYC (Know Your Customer) processes into a simple chat flow, which can increase conversion rates and reach users without requiring them to download a new app or navigate a complex process. In essence, Truora turns WhatsApp into a full-service onboarding and customer support channel for businesses.

Why it’s promising: Truora has quickly gained traction by solving a pain point for Latin American tech companies – verifying customers in a region with less formal credit infrastructure and a preference for mobile messaging. The startup has over 400 corporate clients across 9 countries, including major players like Rappi (on-demand delivery) and Mercado Libre (e-commerce). This client base generates around half a million user verifications per month on Truora’s platform, contributing to a solid recurring revenue stream. To fuel its growth, Truora raised $15 million in a Series A round in 2022 led by Propel and Accel, valuing the company at about $75 million post-money. Notably, two of Truora’s co-founders are ex-Twilio engineers, and the startup went through Y Combinator – signals of strong technical chops and global ambition. With operations in Colombia, Mexico, Brazil, Chile, Peru and more, Truora is expanding region-wide and especially targeting Mexico’s huge market as a growth focus. As digital services and fintech boom in LatAm, the need for seamless onboarding and fraud prevention is rising in tandem. Truora’s WhatsApp-based approach meets customers on a familiar platform, giving it an edge in user experience. The company’s momentum, investor backing, and integration of identity tech into everyday messaging position it as a potential leader in Latin America’s emerging regtech and identity verification space.

Conclusion

From AI chatbots with massive viral growth to fintech solutions leapfrogging legacy infrastructure, these five startups exemplify the dynamism of early-stage innovation worldwide. Each is tackling a large market with a novel approach – and has secured significant early traction or funding as a result. While still in the early innings (pre-seed through Series A), their strong momentum and visionary goals make them well worth watching for investors and tech enthusiasts alike. If these companies execute on their promise, they could not only achieve outsized returns but also drive meaningful changes in their respective industries, from democratizing financial access to advancing new frontiers in technology and medicine.

Sources: The information and data points in this article are drawn from recent reports, news releases, and analyses of the startups’ funding and progress, as cited throughout the text. Each citation corresponds to an external source that provides further details on the startup’s background or achievements. These references offer a deeper dive into why these companies have been identified as standout early-stage startups with high growth potential.