The way we manage money in 2025 is nearly unrecognizable compared to just a decade ago. Thanks to digital banking, saving money has become faster, smarter, and more personalized than ever. From AI-powered budgeting tools to round-up savings automation, the new wave of fintech is reshaping how we approach financial security.

In this article, we’ll explore how digital banking is transforming saving habits, which tools to use, and how to take advantage of these trends — even if you’re on a tight budget.

1. Automation Makes Saving Effortless

Gone are the days of manually transferring money into your savings account. Most modern banking apps now offer auto-save features based on your spending behavior.

Examples include:

Round-ups on purchases (like Acorns or Revolut)

AI-based insights to suggest weekly savings targets

Daily micro-deposits into sub-accounts

Related reading: 10 Practical Ways to Save Money Daily Without Changing Your Lifestyle

2. Personalized Saving Goals

Apps like Monzo, Chime, and N26 let users set individual savings goals with deadlines and track progress visually. Whether you’re saving for an emergency fund, travel, or a big purchase, visual goal tracking makes it easier to stay motivated.

Some apps even gamify the process, rewarding consistency with badges, stats, and friendly nudges.

Want to get started? Read How to Build an Emergency Fund Fast on Any Budget in 2025

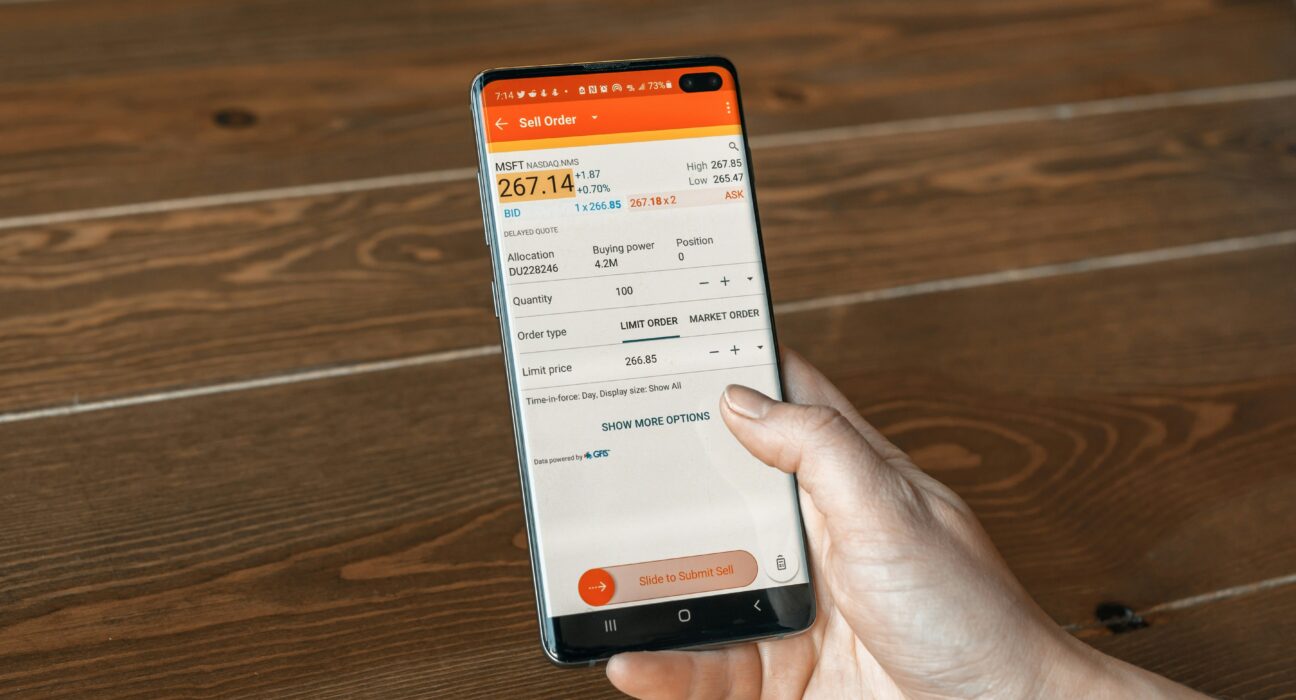

3. Saving Is Now Global and Mobile

Thanks to international-friendly banks like Wise and Revolut, you can save, convert, and move money across borders with minimal fees — perfect for digital nomads or remote workers.

This global access to banking services has made it possible to:

Earn interest in multiple currencies

Move savings between local and foreign accounts

Use your phone as a full-service bank, wherever you are

Explore more: Why Everyone Is Talking About Digital Nomad Visas in 2025 — And How to Get One

4. AI-Powered Budgeting and Insights

Digital banking apps now analyze spending in real-time to recommend how much to save each week. Some even warn you before you overspend.

Features to look for:

Smart notifications (“Your grocery bill is up 12% this month”)

Spending breakdowns by category

Monthly savings trend reports

Need help spotting bad habits? Check out How to Spot Fake Financial Advice on Social Media in 2025 to avoid misleading money tips.

5. Built-In Savings Accounts and Vaults

Many digital-first banks now include separate “vaults” or sub-accounts designed for saving. You can:

Lock funds for a set time

Name and categorize your goals

Add rules (e.g., move $10 to savings when you get paid)

These built-in tools reduce the friction of saving and make it part of your everyday banking experience.

6. Fewer Fees, More Growth

Traditional banks often charge monthly fees, overdraft penalties, or require high balances to earn interest. Digital banks tend to:

Offer zero-fee accounts

Pay higher interest on savings

Reward consistent savers with bonuses

This means: You keep more of your money and watch it grow faster — without doing more work.

Final Thought: Digital Banking Is a Money-Saving Ally

In 2025, saving money is no longer a slow, boring process. Thanks to digital banking, it’s more like having a smart assistant in your pocket — one that helps you spend smarter and save consistently.

The tools are out there. Whether you’re just starting to save or looking to optimize your financial flow, digital banking is changing the game — and making it easier for everyone to win.