Forget the white picket fence, retirement at 65, and climbing the corporate ladder. For Gen Z, the blueprint for wealth is being rewritten. In 2025, this generation is reshaping financial norms, from embracing digital assets and side hustles to prioritizing freedom and flexibility over status symbols. This isn’t just a generational quirk—it’s a signal of where money culture is heading.

In this article, we’ll explore the rising trends Gen Z is driving and what it means for personal finance, business, and society as a whole.

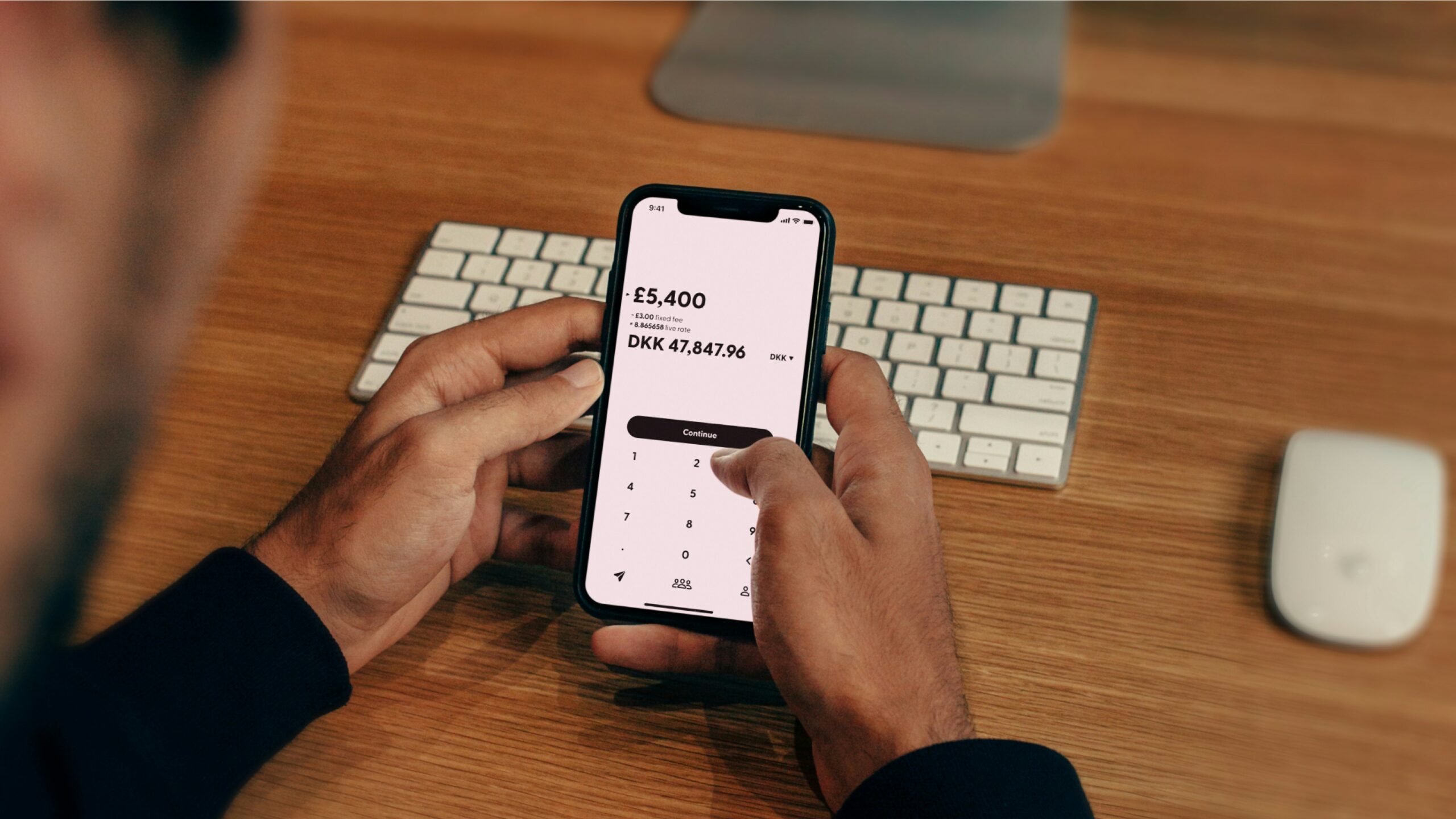

From Ownership to Access

Gone are the days of “buy to own.” Gen Z prefers renting, sharing, and subscribing—whether it’s for fashion, homes, or cars. This access-over-ownership mentality is disrupting traditional industries and paving the way for:

Co-living and micro-renting platforms

Streaming everything—from content to coworking

Peer-to-peer lending and asset-sharing

🔗 Explore: Rent Your Stuff: The Easiest Side Hustle You’re Probably Ignoring

Financial Literacy Is Trending

TikTok, YouTube, and podcasts are the new classrooms. Gen Z is consuming bite-sized finance content like never before.

#FinTok has over 2 billion views.

Budgeting apps and no-fee investing platforms are Gen Z essentials.

Community-based finance groups are booming.

This shift is making financial literacy more approachable and less elitist—but also opens the door to misinformation and scams.

Earning Is Digital-First

Gen Z doesn’t just want jobs—they want income ecosystems. The traditional 9-to-5 is just one piece of the puzzle.

Top Gen Z earning channels:

Freelancing & gig apps

Digital products & content creation

Affiliate marketing & e-commerce

Micro-investing apps

Passive income isn’t a dream—it’s a plan.

🔗 Next read: 5 Simple Ways to Start Building Passive Income

Crypto & Digital Assets Are Identity

Even with a volatile market, Gen Z still leans into crypto, NFTs, and digital collectibles. But for them, it’s not just about making money—it’s about belonging, identity, and cultural value.

Crypto = community

NFTs = digital art and status

DAOs = decentralized belonging

They’re building and investing in what they believe in—even if it’s not “safe” in the traditional sense.

Ethics Over Excess

For Gen Z, values drive value. They’re more likely to support businesses that align with their beliefs, even if it costs more.

This means:

Sustainable brands are winning.

DEI and transparency matter more than logos.

Ethical investing is growing.

Companies that can’t adapt will get left behind.

Final Thoughts

Gen Z isn’t waiting for permission—they’re building the financial world they want to live in. It’s faster, more flexible, and more value-driven than ever before. Understanding their trends now gives us a preview into the future of money for everyone.