Smart investing is about more than picking the right assets—it’s about knowing how and when to exit them. For investors who hold rare or high-value cars as part of their portfolio, one common mistake stands out: selling through a traditional auction house.

With double-digit commissions, loss of control, and the risk of publicly “burning” your asset’s value, auctions often erode both return and flexibility. Whether you’re cashing out a seven-figure Ferrari or a modern Porsche halo model, the auction model is stacked in the house’s favor—not yours.

In this collaboration with Carrozzieri-Italiani.com, we break down the hidden math and market psychology that make auctions a poor strategy for serious car investors—and share what you should be doing instead.

Why Investment Cars Should Not Be Sold at Auction

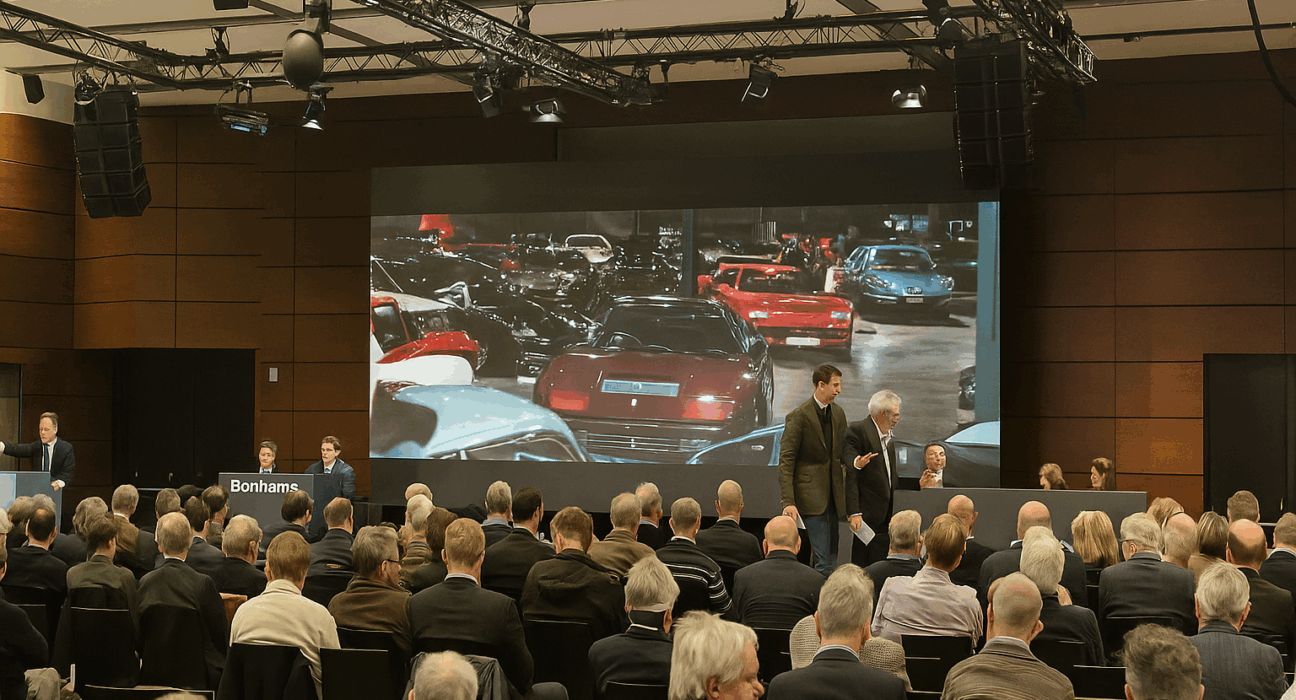

Selling a high-end “investment grade” car at a public auction might seem glamorous – the bright lights, the gavel, the thrill of bidding – but for private sellers and collectors it often does more harm than good. Auctions were designed to serve the auction houses as much as the sellers: they take commissions from both sides, impose strict processes, and can leave your prized car’s value diminished if things don’t go perfectly. In this article, we break down five key reasons (with real examples) why selling an investment car at auction can be a costly mistake, and we conclude with smarter alternatives that savvy collectors are using instead.

High Auction Fees Severely Erode Your Returns

Traditional car auctions charge hefty fees to both the seller and the buyer, which can dramatically cut into the proceeds you receive. It’s not uncommon for auction houses to levy around a 10–15% commission on the hammer price for sellers, and similarly around a 10–12% buyer’s premium on the purchase price, often plus VAT/taxes. In practice, this means the auction house might take roughly 20% (or more) of the total value of the sale. Every dollar that goes to fees is money not going into the seller’s pocket. Put simply, you are paying a massive toll for the privilege of selling on the auction stage. This high cost structure makes it very difficult for sellers to maximize their returns. In fact, in some auction scenarios, the buyer’s premium alone can drive the final price paid 30% above the hammer price – yet none of that premium goes to the seller. All told, the auction model “takes food off both sides of the table,” skimming a significant cut from both buyer and seller. For an investment-grade car that might fetch six or seven figures, those fees can equate to tens of thousands (even hundreds of thousands) of dollars lost to the auction house.

Example – Ferrari 458 Speciale Aperta: Consider a Ferrari 458 Speciale Aperta that achieves a hammer price of £700,000 at a live auction. Between the seller’s commission and the buyer’s premium (often around 10–15% each, plus VAT in Europe), the auction house might take on the order of £140,000 in fees. The seller in this case would end up with only around £623,000 net. In other words, well over six figures of the car’s value vanishes into the auction’s coffers. Such high fees significantly reduce the seller’s return on an investment car – effectively penalizing the seller for using the auction platform. This example illustrates the stark math of auctions: even when a car sells for an impressive price, the owner may lose a large chunk of that upside to transactional costs.

Overshadowed by Dozens of Other Cars

At high-profile car auctions, your vehicle is just one of dozens or even hundreds of lots competing for attention. Investment cars perform best when they’re given a spotlight – a focused narrative that draws out the right buyers. In an auction, however, it’s easy for even a rare car to get lost in the crowd of listings. The schedule is often jam-packed, and bidders’ attention is constantly pulled from one lot to the next. If your car isn’t a headline lot, it may come and go in a matter of minutes, overshadowed by more famous or flashy cars crossing the block around the same time. The result can be lower bidding enthusiasm and a below-market sale price for your car. As one market observer noted about a recent major auction week, “a lot of the biggest cars failed to sell” and many sold only at the low end of estimates – largely because there were “just too many cars and sales” happening at once. In an overcrowded auction, even strong vehicles struggle to stand out, and potential buyers may simply miss the chance to bid or hold back, hoping for another opportunity later.

Example – Porsche 911 GT2 RS Lost in the Shuffle: Picture a highly desirable Porsche 911 GT2 RS consigned as one of over 80 high-end cars at a marquee evening auction. By any measure, the GT2 RS is a top-tier modern collectible. But on this night it’s Lot 50-something, coming after a run of Ferrari supercars and just before a crowd-favorite vintage Aston Martin. With so many highlights in one event, the GT2 RS fails to command the full spotlight. Bidding ends below expectations, and the car sells for less than similar examples had achieved in private sales. The seller is left disappointed, recognizing that their Porsche was essentially drowned out by the sheer volume of prized cars on stage. This scenario underscores how an investment car can underperform at auction simply because of context – the very real risk of being a great car in the wrong place at the wrong time.

Pressure to Accept a Suboptimal High Bid

Auctions create an environment of high pressure – not just for buyers to bid, but for sellers to accept whatever the top bid happens to be. Auction houses prioritize sell-through rate; they want as many lots sold as possible, since unsold lots (or lots that don’t meet reserve) reflect poorly on the sale. As a result, if bidding on your car stalls below your reserve price, the auctioneers and specialists will often push you to make a tough choice in the heat of the moment. It’s common for the auction house to pull the seller aside during or immediately after the bidding and urge them to lower their reserve or accept the highest bid, even if it’s less than you wanted. The atmosphere – the hammer about to fall, a crowd watching, the implicit promise that “this is the best you’ll get” – can be intensely coercive. Many sellers end up agreeing under duress, selling their car for a suboptimal price because the auction setting makes it hard to hold firm. Remember, the auction house gets a commission whether you sell high or low, so their incentive is simply to ensure a sale happens. This can be at odds with your incentive, which is to maximize the price or otherwise not sell at all.

Example – Lamborghini Murciélago Under the Hammer: Imagine you’ve consigned a limited-edition Lamborghini Murciélago with a reserve price of £200,000. The bidding, however, crests at just £180,000 – a full 10% under your reserve. The auctioneer pauses, looks toward you, and a representative quickly escorts you backstage. In a tense side conversation, they pressure you with lines like: “£180K is a strong bid, we recommend you take it,” and “If you don’t sell now, you might not get another offer this good.” With the crowd murmuring and the clock ticking, you feel pushed to accept £180K then and there. However, by yielding to this pressure you’d be locking in a below-reserve sale. (In one real estate auction parallel, a seller who resisted pressure later sold his asset privately for significantly more – a scenario that likely applies to cars as well.) If you have confidence in your car’s value, walking away from an under-reserve high bid can be the smarter move. Unfortunately, the auction format makes that walk-away exceedingly difficult in practice – many sellers “crumble” under the auctioneer’s urging and later regret letting their car go for less than it was worth.

Unsold Auctions Damage the Car’s Perceived Value

What if you don’t give in to pressure and the car fails to meet its reserve? In an auction, that results in a very public “no-sale.” An unsold lot (often announced as “Bid goes on” or simply listed as Not Sold) can attach an unwelcome stigma to your investment car. Collectors and market observers see that the car crossed the auction block and no one was willing to pay the reserve price. Fair or not, this creates a perception that the car was “overpriced” or that demand was weak. In the collector car world, news of an auction no-sale travels quickly through price databases, forums, and dealer conversations. This can make future buyers wary – they might low-ball offers or avoid the car, assuming “if it didn’t sell at auction for £X, it must not be worth £X.” In the art market, experts even use the term “burnt” to describe an unsold auction lot, noting that it diminishes the item’s market appeal and future value. The same holds true for cars: an auction failure can linger on a car’s reputation. It may take significant time (or a price reduction) to shake off the taint of an unsuccessful public sale.

Example – Porsche 911 Turbo (993) “Unsold” at Auction: A collector offers his rare Porsche 993 Turbo at a major auction with a reserve of £200,000, in line with market estimates. Bidding tops out at £175,000, and the reserve is not met – the auctioneer declares the lot unsold. This outcome becomes a matter of record. In the weeks following, the owner tries to market the 993 Turbo through other channels, but savvy buyers reference the auction result. One dealer bluntly tells him, “Nobody bit at £175K in the auction, so the car’s not worth £200K.” The unsold auction attempt has “burned” the Porsche’s value in the eyes of the market. Ultimately, the owner has to lower his asking price or hold the car longer to wait for market sentiment to recover. The lesson is clear: failing to sell at auction not only yields zero proceeds in the moment, but it can also undercut the car’s perceived value going forward, making it harder to sell except at a discount.

Long Consignment Timelines and Added Risk

When you consign an investment car to an auction, you’re signing up for a lengthy, inflexible process. Major auction events are scheduled infrequently – perhaps a few big sales per year – so you might have to wait several months from the time you decide to sell until the auction actually takes place. During this period, your capital is tied up and the car is often out of your hands (perhaps shipped to the auction house early for photographing, cataloging, and previews). Market conditions can shift in the interim, and there’s always the risk that by auction day, buyer sentiment has cooled. Moreover, the car could incur storage or transport risks, or you might spend on detailing and marketing materials, only to end up with no sale. It’s a long holding pattern with no guarantee of success. If the car sells, you’ve waited months for the payout (and then face the fee deductions we discussed). If it doesn’t sell, you’ve lost precious time and potentially momentum in finding a buyer. In contrast, private sales or online platforms allow you to list and sell on your timeline. The strict auction calendar does not favor sellers who want agility. As one analysis of auctions noted, sellers must adhere to the auction schedule and often have to endure months of lead-up time before they even know if their car will sell. That drawn-out process, combined with the possibility of a no-sale, makes auction consignment a risky proposition for those looking to efficiently liquidate or cash in on a high-value vehicle.

Example – Ferrari F40 on a Slow Boat to the Auction: In January, an owner decides to sell his Ferrari F40, an iconic investment-grade supercar. The next suitable high-end auction isn’t until May, but the owner commits to it, believing a big auction will yield the best price. The F40 is shipped to the auction house in advance and sits in storage for weeks. Come late May, it finally crosses the block. Unfortunately, a slight softening in the market and the appearance of two other F40s at competing auctions mean that bidding is lukewarm. The car doesn’t hit its reserve. Not only is the F40 unsold after a wait of nearly five months, but the owner has also incurred transport, insurance, and cataloguing costs – and now faces the task of finding a buyer all over again. This story highlights the inherent risk in long auction consignments: you invest significant time (and money) in the process, and you may still come away empty-handed. For an investment car, time is money – and auction timelines can squander both.

Smarter Alternatives for Selling Investment Cars

Given these pitfalls, it’s no surprise that many seasoned collectors and sellers avoid the auction route when it comes time to sell an investment-grade car. Fortunately, there are alternative sales strategies that can often yield better results with far less headache:

- Private Brokerage or Dealer Sales: Instead of an auction, you can work with a specialist broker or high-end dealer who knows your type of car and has a network of collectors. A good broker will quietly shop the car to qualified buyers, negotiate a fair price, and charge a far smaller commission (or make their margin on top of your net price). This one-on-one sale approach avoids the public “stage” of an auction and often results in a cleaner, confidential transaction at a strong price. You set the terms you’ll accept, and there’s no pressure to sell if the right number isn’t met.

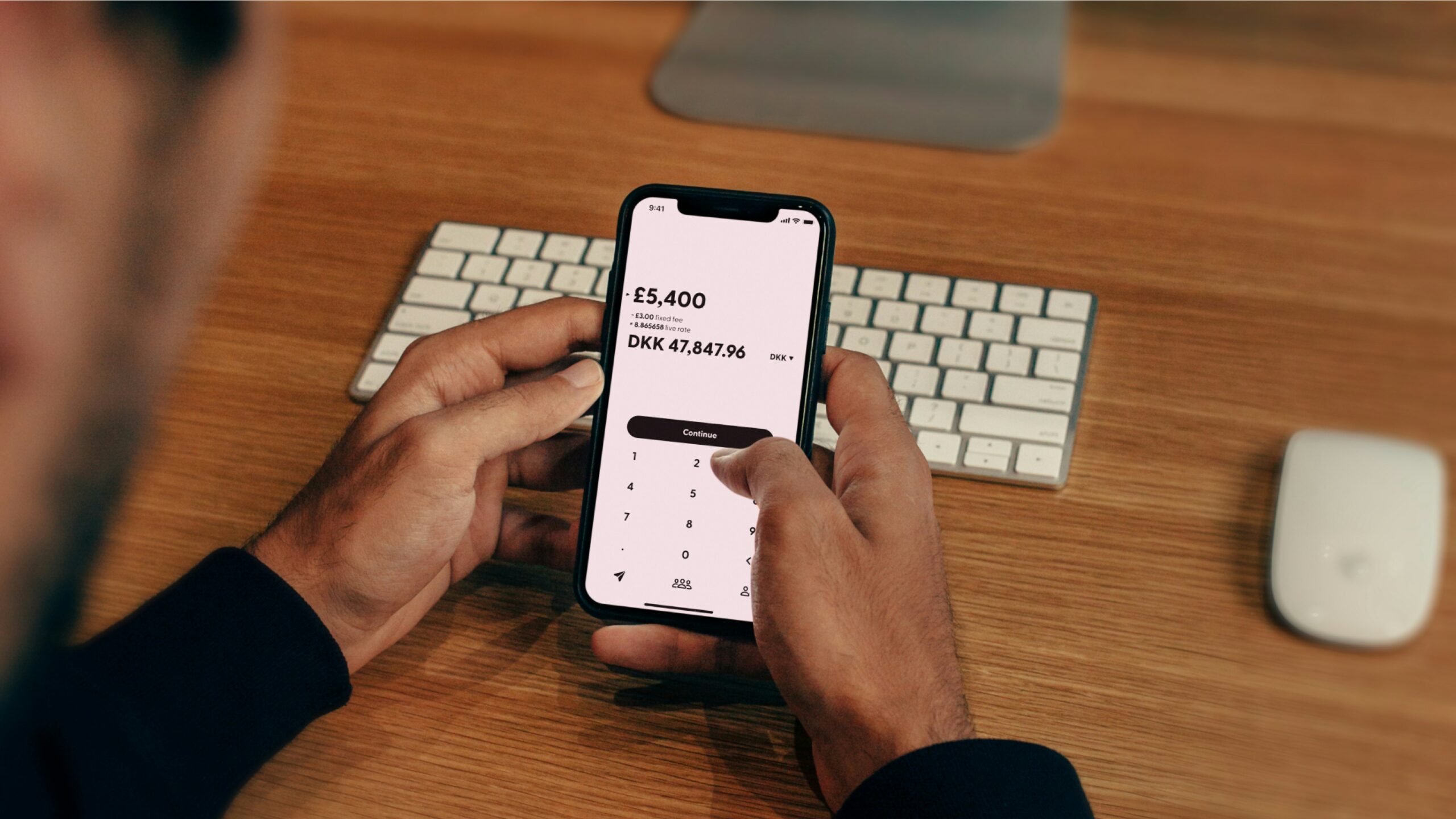

- Curated Digital Marketplaces: In the modern era, several online platforms cater specifically to collectible and investment cars. These range from classified-style sites to curated online auction platforms with lower fees and more seller control. For example, some online auction sites charge the seller little or nothing (relying mostly on a modest buyer fee), which means you keep much more of the final sale price compared to a traditional auction house. Other platforms allow digital consignment listings where your car is presented with full detail to an enthusiast audience – essentially an auction-style listing but without the exorbitant fees and rigid timelines. The key is that digital platforms often operate continuously (no need to wait months for an event) and attract global eyes, all while costing a fraction of what a brick-and-mortar auction charges.

- Direct-to-Collector Networks: Top-tier collectors often know each other, or at least operate within overlapping circles (clubs, events, social media groups, etc.). By leveraging these networks, you can sometimes arrange a private sale directly to another collector who’s been looking for exactly your car. This might be done through word of mouth, at exclusive meet-ups, or via dealer intro – the point is, the car is sold discreetly and directly. Such sales can be win-win: the buyer is thrilled to get the car without competition, and the seller saves on fees and retains control over pricing. There’s also no public record of the price, which keeps the car’s market profile clean (useful for both parties). Private network sales maximize your return and minimize fuss, albeit requiring patience and the right connections.

Conclusion: As co-authors deeply immersed in the collector car world, we urge sellers of investment cars to think twice before consigning to a big auction. The auction block may offer excitement and exposure, but as we’ve analyzed, it often comes at the expense of net profit, control, and sometimes the car’s reputation. High fees slice away your gains; auctions can bury your car among others; you may be pressured into a less-than-ideal deal; an unsold auction can tarnish the car; and the entire process can be slow and uncertain. In most cases, strategic private sales or newer digital platforms are superior options. These alternatives empower you to sell on your own timeline, often with negligible fees, and directly to buyers who truly value your automobile. By avoiding auctions, you can keep a bigger share of your car’s appreciated value and ensure that the sale of your investment car is handled with the care, precision, and financial savvy that such assets deserve. In short, skip the auction hype – and opt for a selling strategy that puts you in the driver’s seat.